Insurance fund

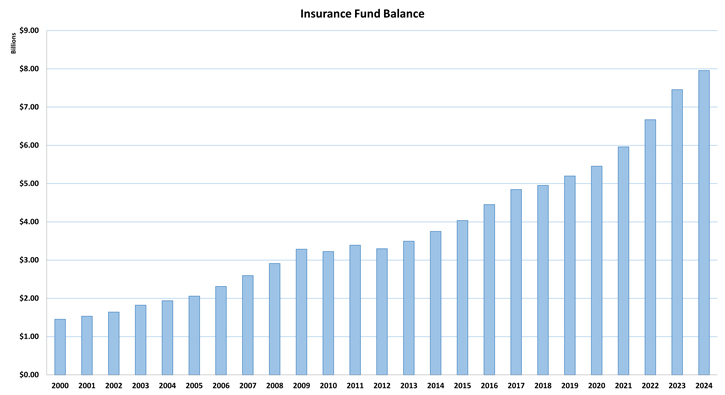

Since FCSIC’s inception in 1989, the Insurance Fund has grown from the initial seed money of $260 million from the United States Treasury to $8.0 billion as of December 31, 2024. While currently funded through collection of premiums from System banks and investment earnings, FCSIC’s Farm Credit Insurance Fund is an asset of the United States government.

Congress directed FCSIC to maintain the Insurance Fund at a statutory target level known as the “secure base amount” (SBA). Congress defined the SBA as 2 percent of the aggregate of outstanding insured debt obligations of all insured banks, adjusted to exclude certain government-guaranteed loans and investments. Because of the deductions, in recent years FCSIC has held around 1.74 percent of total insured debt as the SBA.

Congress also provided that FCSIC, in its sole discretion, may adopt a different percentage it “determines is actuarially sound to maintain the Insurance Fund taking into account the risk of insuring outstanding obligations.” FCSIC has maintained the SBA at the statutory 2% level since the inception of the Insurance Fund and is committed to doing so unless it determines 2% is not “actuarially sound.” To date, FCSIC has concluded that 2% remains actuarially sound.

Please see FAQs for more information about the Insurance Fund