Investment portfolio

The Farm Credit System Insurance Corporation (FCSIC) manages an investment portfolio to support its mission to protect investors in Farm Credit System debt obligations. FCSIC’s primary investment objective is to ensure adequate liquidity to meet its mission and secondarily to optimize the rate of return on the investment portfolio. FCSIC’s Board of Directors has established an investment policy to ensure these objectives are met.

FCSIC is required by law to invest in obligations of the United States or obligations guaranteed as to the principal and interest by the United States. FCSIC’s investment policy limits investments to market-based Treasury securities and provides limits to meet investment objectives. For example, at least 40 percent of the investment portfolio must be in Treasury securities that mature within 2 years. We also limit investment in Treasury securities with maturities of between 5—10 years to no more than 20 percent of the portfolio, and we do not invest in Treasury securities with maturities beyond 10 years.

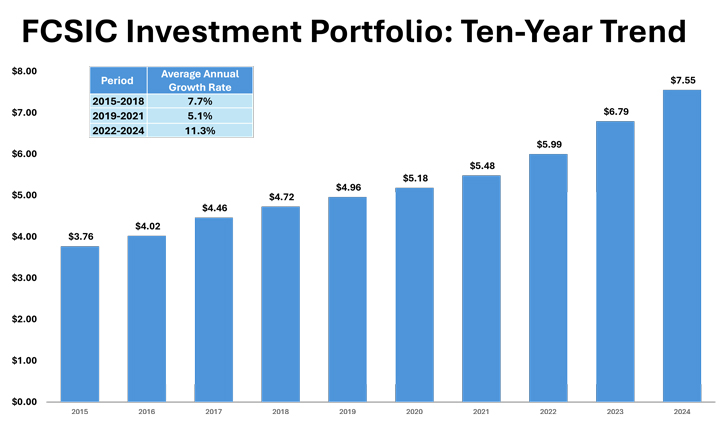

The Insurance Fund has grown considerably over the last 10 years, as shown in the graph below.

FCSIC Investments:

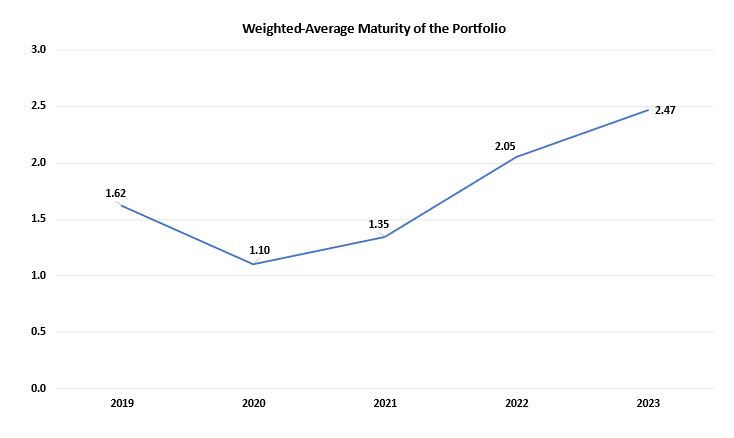

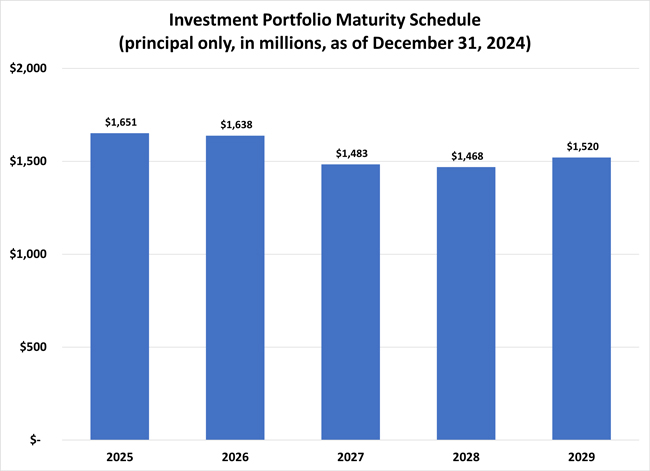

In 2022, FCSIC implemented a five-year bond ladder strategy. Since the end of 2023, the weighted average of the portfolio has remained stable, fluctuating between roughly 2.47-2.50 years. Under the current strategy, FCSIC plans to keep slightly above 40% in the 0- to 2-year range and slightly below 60% in the 3- to 5-year range. The below chart shows the Investment Portfolio’s maturity schedule as of December 31, 2024.

As of December 31, 2024, the weighted-average maturity of the portfolio was 2.48 years, up from 2.05 years at the end of 2022.

Investment Portfolio Results:

FCSIC’s investment performance is described in more detail in our Annual Report.

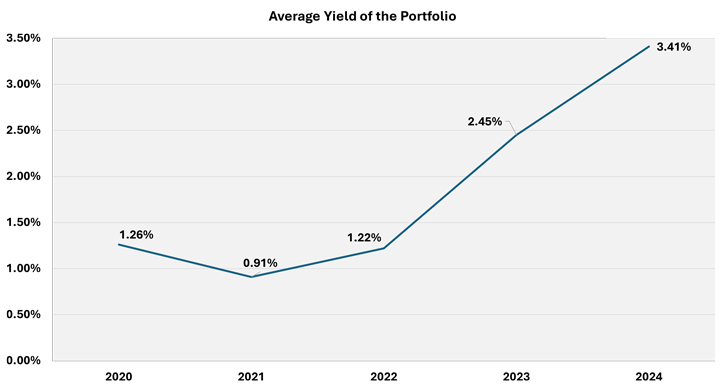

The chart below shows the average yield of our investment portfolio over the last five years. Since interest rates remain elevated, we expect the average yield to continue to rise throughout 2024.

FCSIC’s current investment information is publicly available on the Treasury Direct website at under account number 352X4136.