FAQs

The Farm Credit System Insurance Corporation (FCSIC), a government-controlled independent entity, maintains the Farm Credit Insurance Fund to insure the timely payment of principal and interest on the debt obligations jointly issued by the Farm Credit System banks used to finance the operations of the Farm Credit System. FCSIC seeks to keep a certain amount – called the “secure base amount” – in the Insurance Fund at all times.

How does FCSIC protect investors in agriculture?

What laws or regulations govern FCSIC?

What organizations does the Farm Credit System include?

What is the Secure Base Amount?

What are FCSIC’s objectives in managing the Insurance Fund?

Why does FCSIC continue to use 2 percent as the secure base amount?

What is the effect of the “adjustments” to the secure base amount?

How does FCSIC determine the amount of premiums to charge each year?

What does FCSIC consider when setting annual premium rates?

Can FCSIC charge System banks different rates based on activity or risk factors?

How does FCSIC determine the amount of debt on which premiums are based?

When do banks pay the premiums?

Do System associations pay premiums?

What happens if the Insurance Fund exceeds the secure base amount at the end of the year?

How are premiums are calculated?

How does FCSIC protect investors in agriculture?

Investors provide the funds that the Farm Credit System lends to agriculture and rural America. FCSIC’s primary purpose, as defined by the Farm Credit Act, is to ensure the timely payment of principal and interest on Systemwide debt securities purchased by these investors. If a Farm Credit bank is unable to make a payment to investors on a Systemwide debt security, FCSIC will pay investors out of its Insurance Fund. FCSIC protects investors through sound administration of the Farm Credit Insurance Fund, ensuring that funds are available and employed to fulfill FCSIC’s primary purpose.

What laws or regulations govern FCSIC?

The Farm Credit Act

The Farm Credit Act of 1971, as amended (Act), is the applicable Federal law governing the Farm Credit System, the Farm Credit Administration (FCA), and FCSIC. FCSIC’s authorities are primarily contained in Part E of the Act (sections 5.51-5.65, 12 U.S.C. §§ 2277a-2277a-14).

FCSIC Regulations

Regulations issued by the Farm Credit System Insurance Corporation (FCSIC) Board cover administrative issues for FCSIC employees, the Privacy Act, assessment of FCS institution premiums, collection of claims, golden parachutes, and indemnification payments.

FCA Regulations

FCA develops regulations (rules) implementing the Farm Credit Act and other relevant laws which address the Farm Credit System’s public mission and promote the safe and sound operation of the System. Certain FCSIC regulations make reference to FCA regulations.

What organizations does the Farm Credit System include?

The Farm Credit System is a nationwide Government-sponsored enterprise comprised of cooperative lending institutions and related service organizations that are owned by the agricultural and rural customers they serve.

System organizations include associations, banks, the Federal Farm Credit Banks Funding Corporation and the Farm Credit Council. The Farm Credit Administration is the System’s primary regulator and FCSIC is the insurer of the System banks’ debt obligations. As of January 1, 2017, the System had 74 associations and 4 banks – AgFirst, AgriBank, CoBank and the Farm Credit Bank of Texas.

What are the Premium Basics?

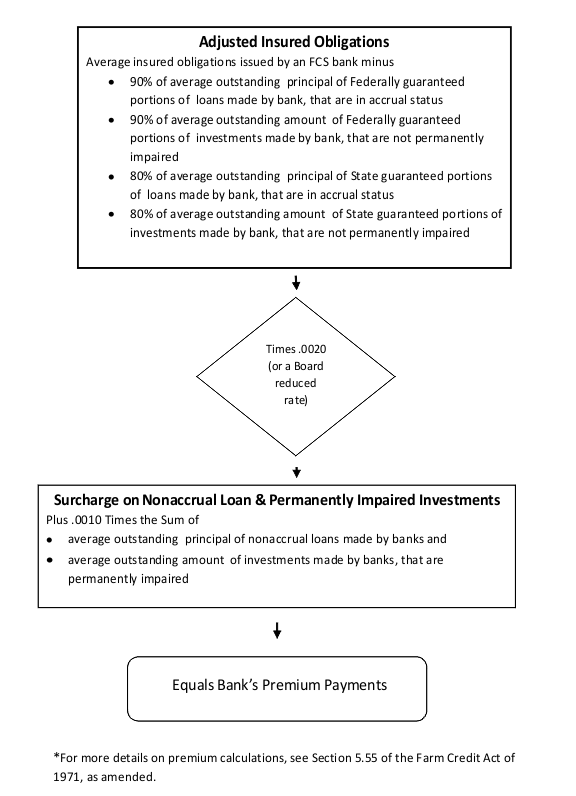

- FCSIC must maintain a “secure base amount” in the Insurance Fund.

- The SBA is equal to 2% of the insured debt issued by System banks in the Insurance Fund MINUS:

- 90% of outstanding amounts of Federal government‐guaranteed loans and investments, and

- 80% of outstanding amounts of state government‐guaranteed loans and investments.

- Statute sets annual premium rate at 20 basis points (0.2%) of “adjusted” insured debt (outstanding debt minus deductions for government-guarantees) unless reduced by the FCSIC Board of Directors.

- FCSIC assesses an additional 10 basis points (0.1%) surcharge on nonaccrual loans and

other‐than‐temporarily impaired investment (OTTI) assets.

What is the Insurance Fund?

The Farm Credit Act requires FCSIC to maintain an insurance fund for the purpose of insuring the timely payment of principal and interest on the obligations jointly issued by the Farm Credit System banks. FCSIC is a Federal government entity and its Insurance Fund is part of the Federal government’s budget. FCSIC maintains and replenishes the Insurance Fund by collecting annual premiums from System banks and through investment returns (the Insurance Fund is exclusively invested in U.S. Treasury securities). The amount in the Fund is based on a percentage of the amount of insured debt issued by the System banks.

What is the Secure Base Amount?

The Farm Credit Act directs FCSIC to maintain a “secure base amount” in the Insurance Fund. The Farm Credit Act states that the secure base amount means, “with respect to any point in time,” 2 percent of the aggregate outstanding insured obligations of all insured System banks (as “adjusted” – reduced -- for government-guaranteed loans and investments). In addition to the 2 percent, the statute allows an alternative. The secure base amount can also be “such other percentage of the aggregate amount as the Corporation in its sole discretion determines is actuarially sound to maintain in the Insurance Fund taking into account the risk of insuring outstanding insured obligations.”

What are FCSIC’s objectives in managing the Insurance Fund?

Annual premiums are set with the goal of maintaining the Fund at the secure base amount and, if necessary, building back to that amount when the Fund falls below 2%. FCSIC believes it is particularly important the secure base amount be achieved while the Farm Credit System is in good health with few problem institutions.

Why does FCSIC continue to use 2 percent as the secure base amount?

Periodically, FCSIC conducts an actuarial review (hiring leading industry actuaries) of the adequacy of the Insurance Fund. To date, FCSIC has sought to maintain the Fund at the 2 percent statutory amount because it has not concluded that any other percentage is actuarially sound taking into account the risk of insuring outstanding insured obligations.

What is the effect of the “adjustments” to the secure base amount?

In calculating the aggregate outstanding insured obligations, FCSIC must exclude 90% of Federally-guaranteed loans and investments made System banks (and their affiliated associations and “other financing institutions” funded by a bank) and 80% of state-guaranteed loans and investments. In recent years, these reductions have meant that the 2% SBA -- based on adjusted debt -- has been equal to approximately 1.66% of total insured debt outstanding. These statutory deductions reflect the reduced risk of loss to the Insurance Fund when System banks hold government-guaranteed obligations.

What constitutes a "government-guaranteed investment" that may be deducted from premium calculations?

The Farm Credit Act defines a “government-guaranteed investment” for premium purposes as one guaranteed:

(a) by the full faith and credit of the United States Government or by any State government;

(b) by any agency or other entity of the United States Government whose obligations are explicitly guaranteed by the United States Government; or

(c) by an agency or other entity of a State government whose obligations are explicitly guaranteed by such State government.

This means that to be deductible, the investment must be either directly issued by, or directly guaranteed by, the government. Securities issued by a private entity backed by government-guaranteed collateral (sometimes referred to as “pass through” or “structured” obligations) DO NOT meet this definition and may not be deducted from premium calculations.

How does FCSIC determine the amount of premiums to charge each year?

While the Insurance Fund needs to equal 2% of adjusted debt, this does not mean that FCSIC charges System banks 2% each year. Instead, FCSIC charges the amount of annual premiums necessary to refill and maintain the Insurance Fund at the 2% secure base amount (i.e., the difference between what’s already in the Fund and the amount needed to keep the Fund at the 2% level).

For any calendar year in which the Insurance Fund does not exceed the secure base amount, the Farm Credit Act directs FCSIC to charge each bank a premium equal to 20 basis points (0.2%) of the adjusted amount of the “average outstanding insured obligations issued by the bank for the calendar year” (plus a 10 basis points (0.1%) surcharge for nonaccrual loans and other-than-temporarily impaired investments).

FCSIC, in its sole discretion, may reduce the percentage charged to the banks below the statutory 20 basis points. As discussed below, the FCSIC Board of Directors annually reviews the Fund and sets a rate between 0 and 20 basis points. As a matter of policy, the FCSIC Board will not reduce the additional 10 basis points premium surcharge for nonaccrual loans and other than temporarily impaired investments, to continue providing an incentive for sound credit extension and administration and sound investment policy.

Upon reaching the secure base amount, FCSIC reduces the annual premium percentage paid by each insured bank so that the aggregate of all premiums paid by the banks for the following calendar year is sufficient to ensure that the Insurance Fund balance is maintained at the secure base amount.

What does FCSIC consider when setting annual premium rates?

Each year, FCSIC looks at various factors to determine the amount of premiums needed to keep the Insurance Fund at the secure base amount, including the amount in the Fund and any shortfall under the secure base amount. FCSIC also considers multiple scenarios that reflect the impact of anticipated and potential growth in Farm Credit System debt levels on the secure base amount. FCSIC considers the projected yearend secure base amount, which is calculated using the System banks’ debt estimates and projected net earnings on the Corporation’s investment portfolio. Prior to making any premium decision for the next year, FCSIC surveys each bank for its growth projections and takes these estimates into consideration in its analysis.

As a basis for its premium assessment decision the FCSIC Board considers the following factors:

-

The current level of the Insurance Fund and the amount of money and time needed to reach the secure base amount;

-

The risk that the Insurance Fund will need to be used in the next 12 months.

Can FCSIC charge System banks different rates based on activity or risk factors?

No. By statute, FCSIC must charge each bank the same percentage rate based on average outstanding obligations issued by the bank.

How does FCSIC determine the amount of debt on which premiums are based?

To determine the “average outstanding insured obligations issued by the bank for the calendar year,” FCSIC looks at principal and interest outstanding at quarter-ends as reported by the banks in their call reports submitted to the Farm Credit Administration. Additionally, each bank files an annual certified statement with FCSIC listing the amount of the bank’s average outstanding insured obligations and average outstanding deductions.

When does FCSIC set premiums?

FCSIC’s Board traditionally sets the premium accrual rate each January for the coming year. FCSIC’s Board reviews the premium assessment schedule at least semiannually and may use its discretion to adjust the premium assessments in response to changing conditions.

When do banks pay the premiums?

System banks make one annual premium payment by January 31 for the prior year’s premiums.

Do System associations pay premiums?

FCSIC only charges System banks for insurance premiums. However, each bank is authorized to pass along the cost of insurance premiums to affiliated associations and other financing institutions that receive funding from the bank so long as it does so in an “equitable manner” (as determined by FCSIC). If an association believes its district bank is not allocating the premium cost equitably, it can bring the issue to the attention of the FCSIC Board of Directors for review.

What happens if the Insurance Fund exceeds the secure base amount at the end of the year?

FCSIC’s premiums are set with the goal of reaching and maintaining the 2% secure base amount. However, if growth of insured debt is greater than forecast when premium rates are established (or the Fund is used for some authorized purpose), the Insurance Fund will end the year below the secure base amount and FCSIC will need to collect additional premiums in the following year to make up the shortfall. If growth of insured debt is less than forecast when premium rates are set, then the Insurance Fund may end the year above the secure base amount.

If the Insurance Fund exceeds the secure base amount at the end of any calendar year, FCSIC allocates those amounts, minus operating expenses and insurance obligations, to “allocated insurance reserve accounts” (AIRAs) established for the benefit of the System banks and holders of Financial Assistance Corporation stock (System banks and certain System associations) in accordance with the formula found at 12 U.S.C. § 2277a-4 (section 5.55 of the Farm Credit Act). Once FCSIC determines that the allocation is appropriate and that the funds in the AIRAs are not otherwise needed, FCSIC may pay the amounts in the AIRAs to the account holders. In 2010, FCSIC returned a total of $205.3 million to System institutions. In 2012, FCSIC returned a total of $221.9 million. In 2018, FCSIC returned a total of $175.8 million.

May AIRA accounts be reduced?

Yes. Reductions may be made in the AIRA accounts to absorb FCSIC expenses and insurance obligations. If such reductions were necessary, each AIRA would be reduced by a proportionate amount in accordance with the statute. The same formula used to make the allocation of excess fund balances will be used to reduce AIRA balances.

FCSIC premium calculation*