General information

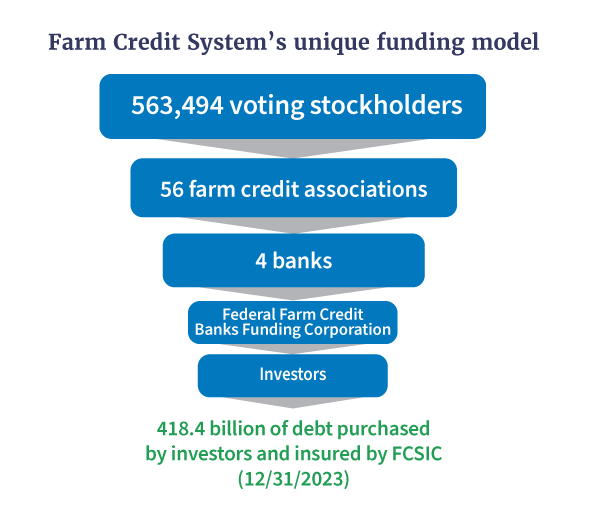

Welcome to the Farm Credit System Insurance Corporation, the government insurer for Farm Credit System debt obligations. Our mission is to protect investors in Farm Credit System debt and to facilitate the delivery of credit to agricultural borrowers.

Here is an overview of the corporation and how we work with the Farm Credit System.

What we do

The Farm Credit System Insurance Corporation (FCSIC) is a Federal, government-controlled corporation established by the Agricultural Credit Act of 1987 (1987 Act). Congress created FCSIC to enhance the financial integrity of the Farm Credit System (System) by insuring the timely payment of principal and interest on certain System notes, bonds, and other obligations purchased by investors. FCSIC is administered by a board of directors who serve concurrently as the Board of the Farm Credit Administration (FCA). FCSIC’s Chairperson is elected by the other Board members, however cannot be the same person as the FCA Chairperson.

What is the secure base amount?

FCSIC administers the Farm Credit Insurance Fund (Insurance Fund) and collects annual insurance premiums from System banks. Congress directed FCSIC to build the Fund to a “secure base amount.”

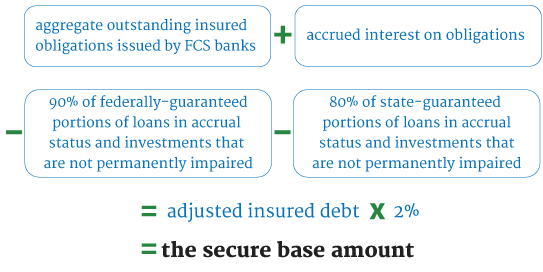

FCSIC collects premiums from System banks to maintain the Insurance Fund at the secure base amount, which is defined as 2 percent of the aggregate outstanding insured obligations of all insured banks, adjusted downward to reflect the System’s reduced risk on loans and investments backed by the full faith and credit of the U.S. Government or a state government.

How we calculate the "secure base amount"

Our other responsibilities

FCSIC has additional mandatory and discretionary responsibilities. They include:

- Ensure the retirement of eligible borrower stock at par value,

- Provide assistance (pdf) to System banks and direct lender associations suffering financial difficulties by providing loans or contributions, purchasing assets and debt securities, assuming liabilities, and facilitating consolidations and mergers,

- Serve as conservator or receiver of any System bank or association placed into conservatorship or receivership by the FCA Board, and

- Serve as conservator or receiver, when appropriate, for other organizations regulated by the FCA

About the Farm Credit System

Learn more

Please refer to the Funding Corporation web-site for additional information on Systemwide Debt Securities.

Page updated: February 22, 2024